Over the recent years, we have witnessed a marked increase in the entry of new players in F&B and consumer durable industry offering ground breaking consumer products due to evolution of consumers in terms of tastes, preferences, lifestyle, need for variety etc. According to a research, the FMCG market in India is expected to cross more than a 100 Billion USDs by 2020 with an expected CAGR growth of about 20.6 in 2019. On the other hand, the consumer durables market is expected to reach 1340 billion by 2020 with an expected growth of 14% CAGR. These new players are competing with the giants head on through retail channels or leveraging e-commerce platforms along with social media promotions to attract potential buyers. While real time data is available for companies dealing through e-commerce channels, there has been a lag in sales data availability in traditional processes i.e., sales through distribution channels owing to the vastness of the network.

With the market becoming tougher by the day, more companies targeting the same set of segments and more multi brand dealing by distributors, it has inevitable for both big & small sized manufacturers to re-engineer their go to market strategies and eliminate redundant processes through amalgamation of digitization and automation with traditional sales and distribution process of the consumer goods market.

While most businesses have understood the importance of analytics to make their business flourish in this fiercely competitive market, present time retailers, manufacturers and marketers have also started relying on advanced analytics to predict demand, emerging market and customer needs.

This has given rise to the adoption of automation tools by large FMCG & FMCD players such as distributor management software (DMS), field force tracking apps and order processing apps for tracking sales, distribution, inventory along with every channel partner activity. These technologies have been specifically developed to facilitate smooth communication and transparency between FMCG/FMCD manufacturers, distributors and retailers.

These automation tools such as distributor management software (DMS), field force tracking apps and order processing apps allows FMCG/FMCD manufacturers to:

- Tracking sales from individual distributors

- Run spot & target schemes and monitor its performance

- Check inventory levels at individual distributors end

- Automate pushing new prices to channel partners

- Set reorder levels

- Keeping track of field sales staff

- Monitor region-wise sales activities to identify real-time scenario of products

- Generate MIS reports within seconds

- Get insights on top performing distributors, areas, SKUs etc

- Average stock replenishment duration of each distributor

- Ideal stocking based on sales pattern

- Insights on which SKU performs how in different regions

- Lets retailers automatically place order through mobile application

- Purchase patterns of each region

Although the adoption rate of sales force automation tool has been high in both big & small FMCG/ FMCD brands, utilization of a more productive sales intelligence tool such as a distributor management software is still limited to large corporations due to heavy infrastructure cost. Little do the new entrants know that it can be avoided by cloud implementation of a distributor management software which will help them tap into the high performing markets quickly and give a positive ROI in the long run.

In order to sustain in the era of digitization, both small and large consumer goods players need to adopt a distributor management software as insights-driven processes will surely become a key trait to generate significant ROI along with growth opportunities. Undoubtedly, 2019 will be a year of huge change in the broad as well as the micro FMCG markets and only those businesses who understand these new and divergent pathways of managing the supply chain network will have a far better opportunity to navigate them successfully.

Recent Posts

Right Approach To DMS

Benefits Of An Onsite Distributor Rollout In DMS

Why Is DMS Important For Automobile Industry?

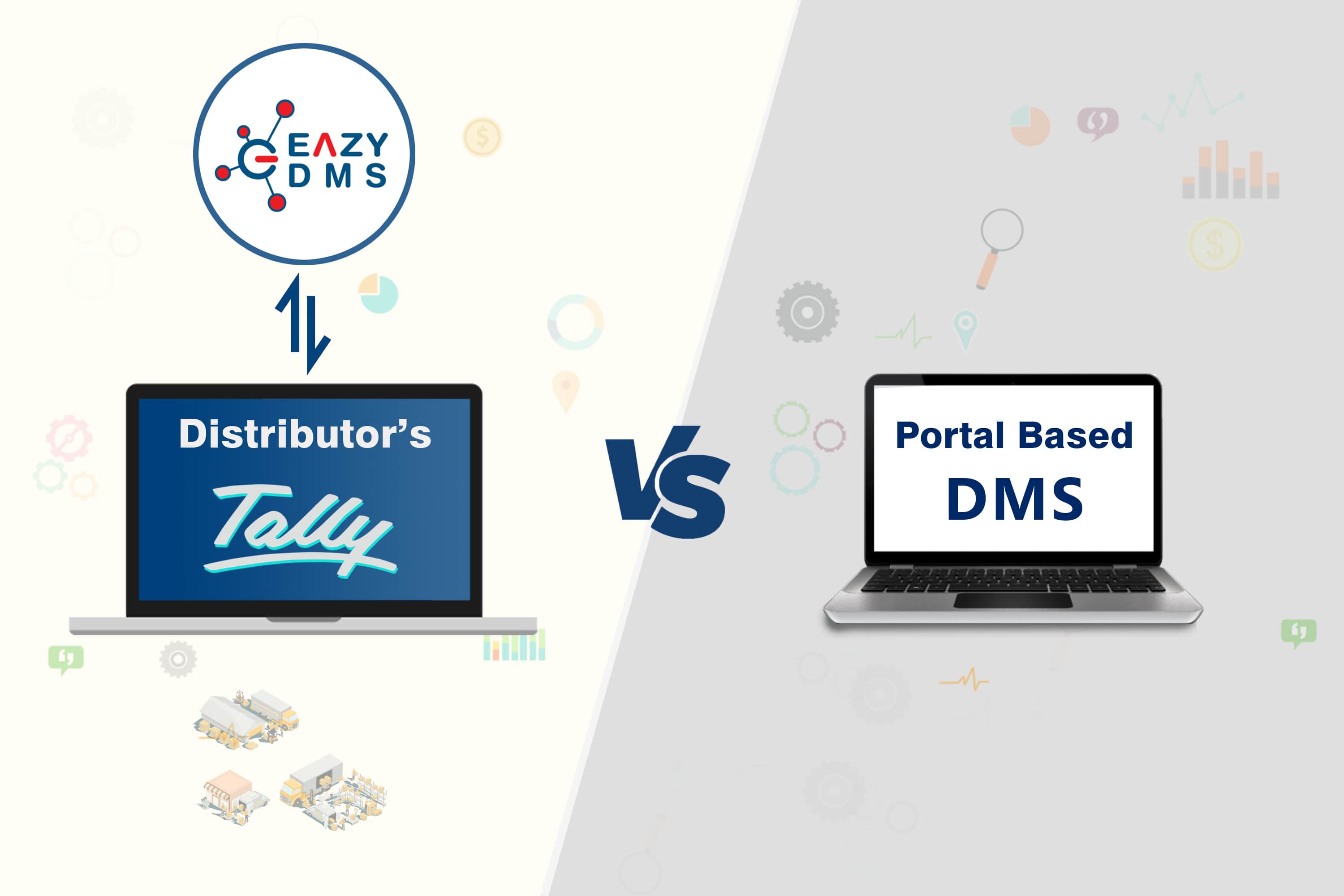

Eazy DMS Vs Portal Based DMS

USP’S Of Eazy SFA

Why do FMCG/FMCD companies need a DMS?

Why Tally integrated DMS?